Exploring High-Yield Investment Options for NRI Investors

Introduction

Non-Residential Indian NRI investors often seek high-yield investment options to maximize their returns and grow their wealth. While there are various investment avenues available, it is essential for NRI investors to identify opportunities that offer attractive yields without compromising on risk management. In this article, we will explore some high-yield investment options for NRI investors to consider.

1. Fixed Deposit Accounts

Fixed deposit accounts with reputable banks are a popular investment choice for NRI investors. These accounts offer a fixed rate of interest over a specific term. The interest rates on fixed deposits are generally higher than savings accounts, providing NRI investors with a reliable source of income and the potential for capital appreciation. It is important to compare interest rates and terms offered by different banks to maximize returns.

2. Mutual Funds

Mutual funds provide NRI investors with a professionally managed investment option that offers the potential for high yields. Equity mutual funds, in particular, invest in stocks and have the potential for capital appreciation over the long term. Debt mutual funds invest in fixed-income securities and offer regular income through interest payments. NRI investors should carefully assess the risk profile, historical performance, and expense ratios of mutual funds before investing.

3. Real Estate Investment Trusts (REITs)

REITs are investment vehicles that allow NRI investors to invest in real estate without directly owning properties. REITs generate income from rental properties, and a significant portion of the earnings is distributed to investors as dividends. These dividends can provide attractive yields for NRI investors seeking exposure to the real estate market without the hassle of property management. Before investing in REITs, thorough due diligence on the underlying assets and the track record of the REIT is crucial.

4. Bonds and Debentures

Investing in bonds and debentures can be another high-yield option for NRI investors. Government bonds and high-rated corporate bonds offer fixed interest payments over a specific period, providing steady income. Debentures, which are issued by corporations, also offer attractive yields. However, it is important to assess the creditworthiness of the issuer before investing in bonds and debentures to manage credit risk.

5. Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms provide NRI investors with an opportunity to earn high yields by lending money directly to borrowers. These platforms connect borrowers and lenders, eliminating the need for traditional financial intermediaries. NRI investors can choose the borrowers they want to lend to and earn interest income on their investments. However, P2P lending carries credit risk, and thorough due diligence on the borrowers and the platform is necessary.

6. Stock Market Investments

Investing in the stock market can provide NRI investors with the potential for high yields through capital appreciation and dividends. However, stock market investments carry inherent risks, and careful research and analysis are necessary to identify quality stocks with growth potential. NRI investors should consider diversifying their stock portfolio and staying updated with market trends and news to make informed investment decisions.

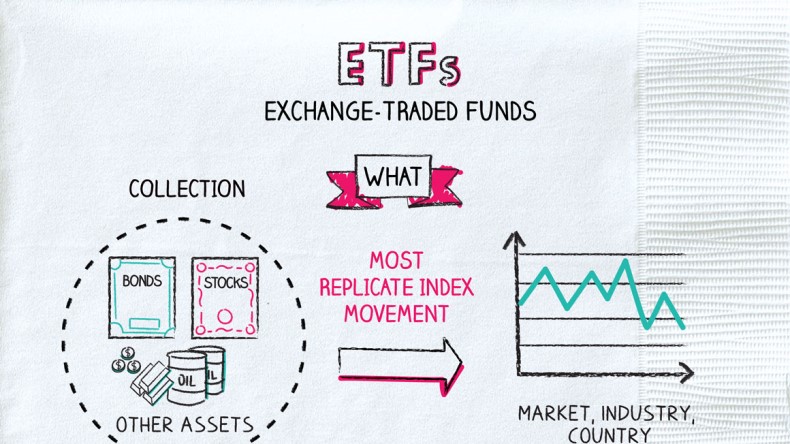

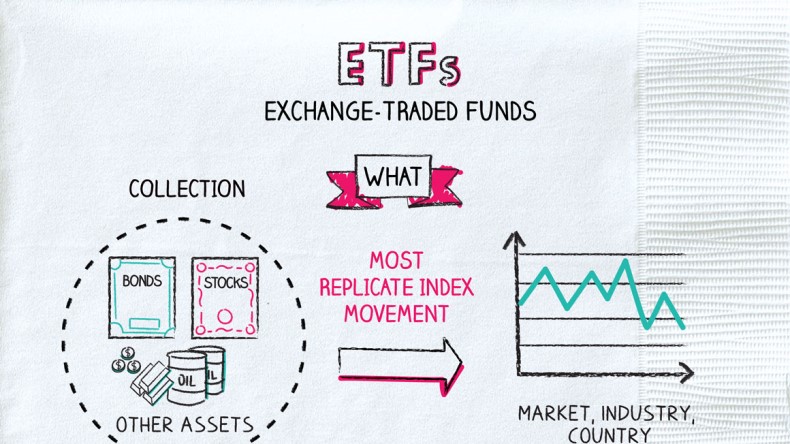

7. Exchange-Traded Funds (ETFs)

ETFs are investment funds that are traded on stock exchanges, providing NRI investors with exposure to a basket of assets, such as stocks, bonds, or commodities. ETFs offer diversification and liquidity, making them attractive for NRI investors seeking high-yield investment options. It is important to assess the expense ratios, tracking error, and underlying assets of ETFs before investing.

8. Real Estate Investments

Real estate investments, such as rental properties or commercial properties, can generate high rental yields and potential capital appreciation. NRI investors can leverage the growth potential of the real estate market while earning regular income through rent. Thorough research on the location, property market, and potential rental demand is necessary before investing in real estate.

Conclusion

NRI investors have a range of high-yield investment options to explore and grow their wealth. It is crucial to assess the risk-reward profile of each investment avenue, diversify the portfolio, and conduct thorough due diligence before investing. Fixed deposit accounts, mutual funds, REITs, bonds and debentures, P2P lending, stock market investments, ETFs, and real estate investments offer opportunities for NRI investors seeking attractive yields. By making informed investment decisions and staying updated with market trends, NRI investors can effectively pursue their financial goals.